AI-Driven Analytics Revolutionize Tax Preparation And Planning

Juggling receipts and tracking deadlines can make tax season stressful, especially when working from a home office. New analytics tools offer a better way to manage this yearly challenge. These tools quickly analyze your expense reports, identify deductions you might have missed, and highlight anything that could raise questions during an audit. You receive clear, actionable insights in just minutes, freeing up valuable time in your schedule. With less time spent sorting through paperwork, you can devote more attention to important projects and calls, confident that your taxes are under control and that no crucial detail will slip through the cracks.

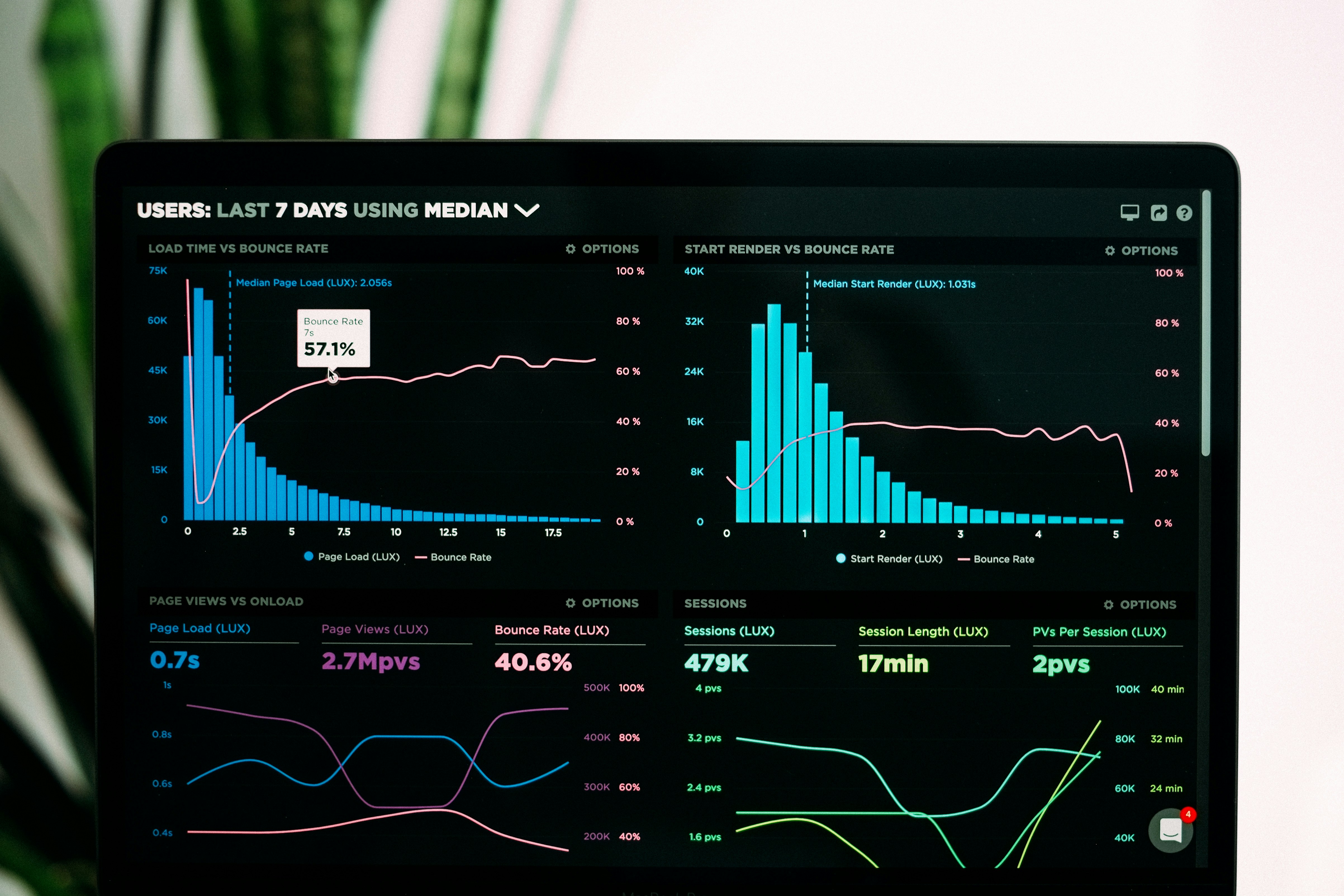

Modern analytics use machine learning to scan your financial data. They connect bank feeds, invoices, and contractor payments into clear dashboards. You see where your expenses spike, which categories need documentation, and how estimated payments compare to actual liabilities. Smart alerts remind you to act on missed deadlines. Teams spread across time zones gain a unified tax view—no more chasing spreadsheets or outdated PDFs.

Tax Preparation Basics in the AI Era

- Automated data import: Connect bank accounts and credit cards so you track transactions in real time.

- Receipt scanning: Take a photo, and optical character recognition pulls out dates, amounts, and merchant names.

- Categorization rules: Set custom rules to classify expenses consistently across projects or clients.

- Audit risk scoring: Get alerts when patterns suggest missing forms or unusual deductions.

Every freelancer or consultant needs a system that reduces manual entry. You assign categories once, and the tool applies them to similar transactions. When you travel for work, uploads from your mobile device flow directly into your tax workspace. This hands-off process reduces data errors and keeps expenses organized for quarterly filings.

Outsourced accountants and small finance teams also benefit. They access a live tax ledger, approve entries, and generate draft returns in seconds. Collaboration happens within the same dashboard rather than through email chains. That clear workflow speeds up sign-off and reduces back-and-forth over missing receipts.

Top AI-Powered Analytics Tools for Tax Planning

- QuickBooks Advanced Analytics: It uses predictive models to forecast quarterly tax liabilities, providing visual reports you can adjust quickly.

- TurboTax Live+: This tool adds AI checks to ensure you claim credits specific to remote work, like home office deductions and internet expenses.

- Xero Tax Insights: Xero detects patterns to flag duplicate entries and automatically reconciles bank statements.

- Avalara AvaTax: It calculates sales tax across 12,000 jurisdictions, updating rates in real time so your invoices stay compliant.

- CCH Axcess Analytics: This enterprise-level platform analyzes historical filings to recommend optimal filing strategies and identify audit risks.

Each tool integrates with popular payment platforms and project management apps. For instance, you connect QuickBooks to Stripe or PayPal. That makes tracking income from multiple clients seamless. If you bill through Upwork or Fiverr, these tools import payout data automatically.

You can combine different tools. Some freelancers prefer TurboTax for personal returns and QuickBooks for business analytics. Others use Avalara only when handling taxable goods. The key is choosing tools that fit your workflow instead of forcing you to change your processes.

Advantages and Challenges of AI Analytics in Tax Preparation

Automated analytics reduce time spent on tax tasks by up to 70%, according to industry surveys. You no longer wrestle with spreadsheets or outdated macros. Instead, you focus on strategy—identifying spending patterns or researching new credits. Dynamic dashboards give a quick overview of your tax health at any moment, helping you avoid surprises when deadlines approach.

But adopting new technology introduces challenges. Data privacy is a top concern: you share sensitive financial details with cloud-based platforms. Check encryption standards and choose providers with SOC 2 compliance. Trust is another issue. Machine learning might misclassify expenses if you skip regular rule audits. It’s wise to review category assignments quarterly and update rules as your business changes.

Teams sharing accounting duties across locations may encounter integration issues. Different jurisdictions and payment systems require custom configurations. Expect an initial setup phase where you fine-tune APIs and user roles. Once completed, you will enjoy increased efficiency for future tax cycles.

Cost considerations also matter. Some AI platforms charge per user or based on transaction volume. Compare pricing tiers with your expected filing complexity. For simple schedules, a lightweight tool may be enough. More comprehensive platforms justify higher fees through accurate forecasts and audit protections.

Implementing AI Solutions: A Step-by-Step Process

Begin by mapping your current tax workflow. List data sources, filing deadlines, and approval points. This plan helps you select a set of tools that align with your existing steps instead of disrupting them.

Next, test a core feature such as data import. Connect one bank account or payment gateway and see how transactions flow into the system. Check accuracy and review classification results. Confirm that mobile scans extract correct details from receipts.

Third, create custom rules. Define expense categories for client projects, travel, subscriptions, and equipment. Set thresholds for high-value transactions that need manual review. Over time, the AI engine learns from your corrections and improves its sorting.

Then, train your team members. Host a 30-minute demo to walk through dashboards and approval workflows. Prepare short guides with screenshots. Encourage users to report misclassification or integration issues immediately.

Finally, schedule quarterly audits. Compare AI summaries with original records. Adjust rules or update integrations as needed to accommodate new clients, payment methods, or tax law changes.

Future of Tax Planning with AI

Analytics platforms will become more conversational. Expect chat interfaces that answer complex tax questions in natural language. You might ask, “What if my home office expenses double?” and receive real-time projections. Bots will recommend filing extensions based on cash flow forecasts.

Blockchain integration could provide secure, tamper-proof audit trails. Every expense receipt and approval might live on a distributed ledger, making compliance checks easier. Smart contracts could trigger estimated tax payments automatically once you reach revenue milestones.

Voice assistants could help you record expenses hands-free and assign categories by speaking. Imagine adding a new contractor invoice through voice command while multitasking. These features will free up mental space for creative work that remote roles demand today.

Smart analytics simplify tax preparation and save you time. Use the tools and keep your rules current to improve your workflow and gain a competitive edge.